Introduction: Two Metrics That Make or Break a Deal

Imagine scouting a rental property in a Colorado mountain town. The rent looks promising, but when you run the numbers, the returns fall short.

A common reason? Investors often confuse cap rate and cash-on-cash return.

Both are powerful — but they measure different things.

- Cap rate evaluates the property.

- Cash-on-cash evaluates your money.

Get them right, and you can spot winners. Get them wrong, and you risk a money pit.

In this breakdown, we’ll keep it simple. I’ll walk through both metrics with real examples — and show how Fort + Home’s precision-built housing model strengthens both through cost control, faster delivery, and efficient operations.

Step 1: Start with NOI — Net Operating Income

Think of NOI as the property’s take-home pay before the mortgage or taxes.

Formula:

Gross Income − Operating Expenses = NOI

- Gross Income includes rent and other income sources (parking, storage, laundry).

- Operating Expenses include taxes, insurance, repairs, utilities you cover, and management — but not loan payments or depreciation.

Example:

If a duplex earns $36,000 per year and expenses total $12,000, then NOI = $24,000.

NOI is the foundation of real estate finance. It drives valuation, lender confidence, and investor decisions.

At Fort + Home, our precision-built homes are engineered to lower operating costs from day one — tighter envelopes, higher energy performance, and fewer repairs — so NOI starts stronger and stays stronger.

Step 2: Understanding Cap Rate

Formula:

Cap Rate = NOI ÷ Value × 100

Cap rate represents the property’s unlevered return — how efficiently it generates income before financing.

Example:

$24,000 NOI ÷ $400,000 value = 6% cap rate.

Hot, low-risk markets like Denver or Aspen often trade at 4–5% caps, while higher cap rates usually indicate perceived risk or operational upside.

When interest rates rise, investors demand higher returns. Cap rates increase, which lowers asset values because:

Value = NOI ÷ Cap Rate

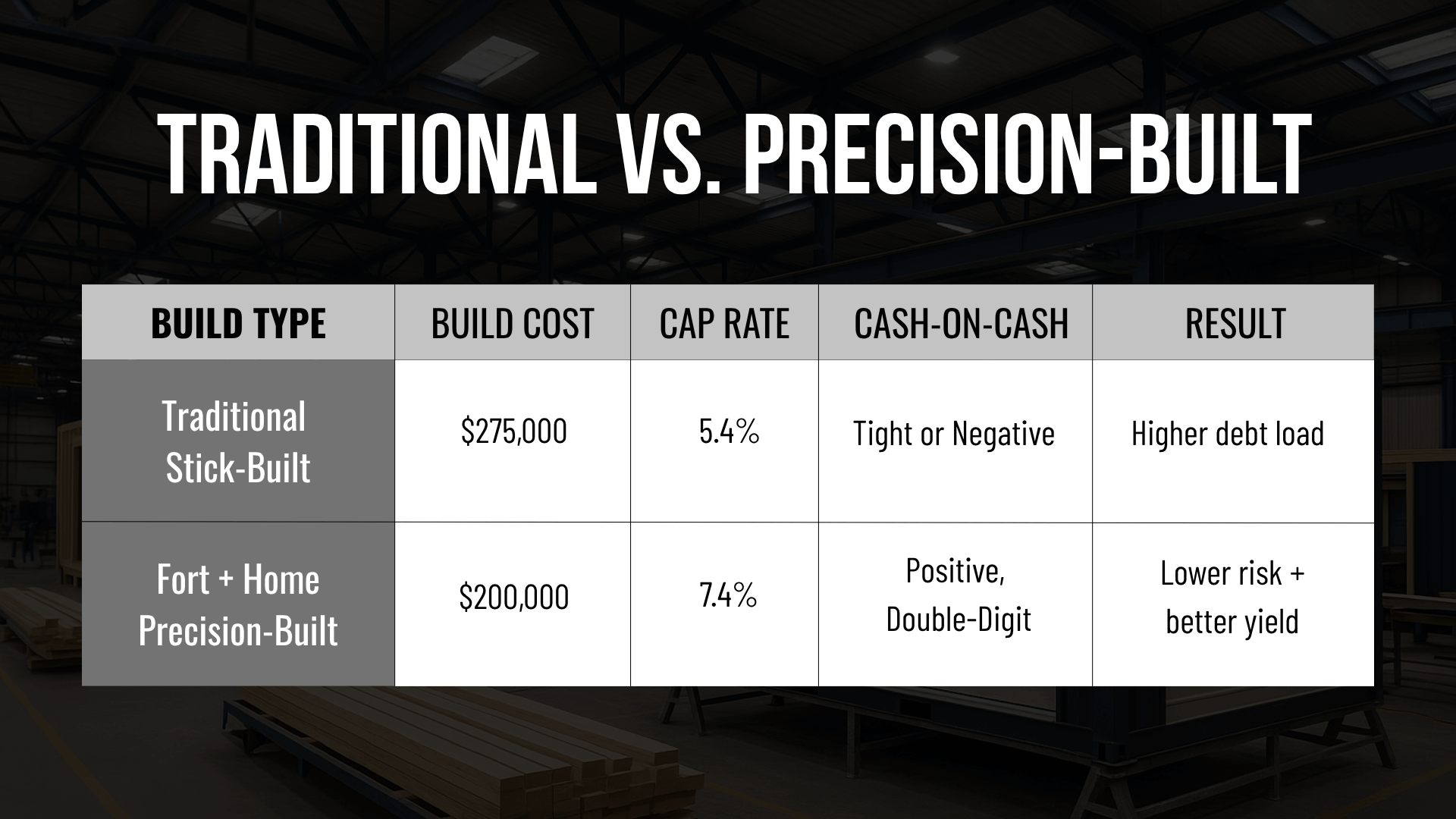

Fort + Home’s advantage lies in cost control. By cutting build costs 20–25%, our projects can lift cap rates by 1–2 points at the same rent level — without speculative assumptions or risky rent growth.

Step 3: Understanding Cash-on-Cash Return

If cap rate measures the property, cash-on-cash measures your equity’s productivity — how efficiently your invested cash performs after financing.

Formula:

(NOI − Annual Debt Service) ÷ Equity × 100

Example:

NOI = $24,000

Debt Service = $15,000 per year

Equity = $80,000

$24,000 − $15,000 = $9,000 cash flow ÷ $80,000 = 11.25% cash-on-cash return.

If you buy with no debt, your cash-on-cash equals the cap rate.

Cash-on-cash reflects what you actually earn — the real return on your capital.

Fort + Home’s faster delivery cycles — homes completed in weeks, not months — help investors reach stabilized occupancy sooner, generating cash flow faster and minimizing unproductive carry.

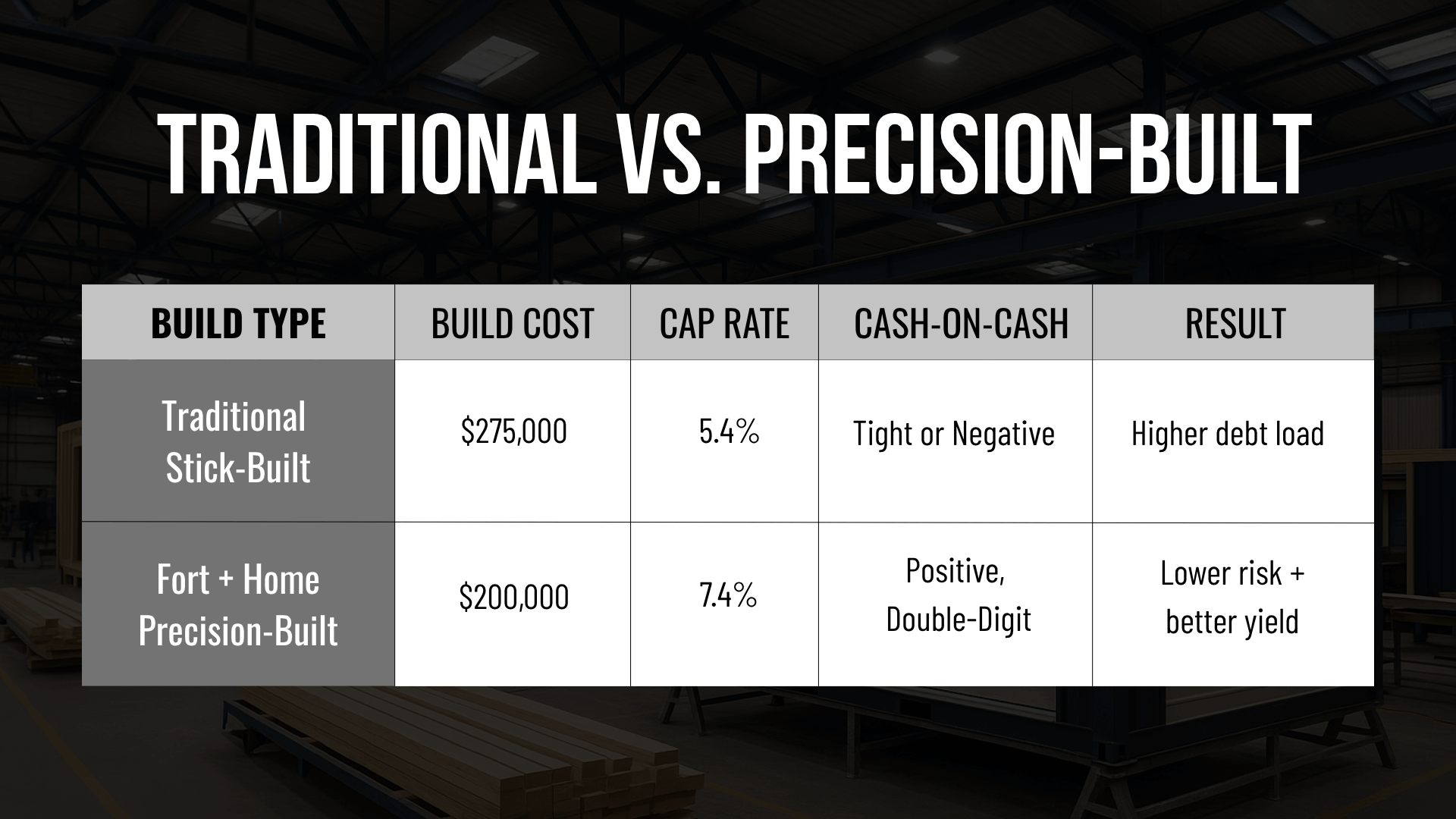

Step 4: Side-by-Side Example — Traditional vs. Precision-Built

Let’s compare two identical 1,000 sq. ft. rentals in Western Colorado, each renting for $1,900 per month with a 35% expense ratio (NOI = $14,820).

Same rent. Same tenant. Same expenses.

The difference? Cost per square foot — controlled upstream in our factory.

When you reduce construction cost at the source, you directly improve both cap rate and cash-on-cash return.

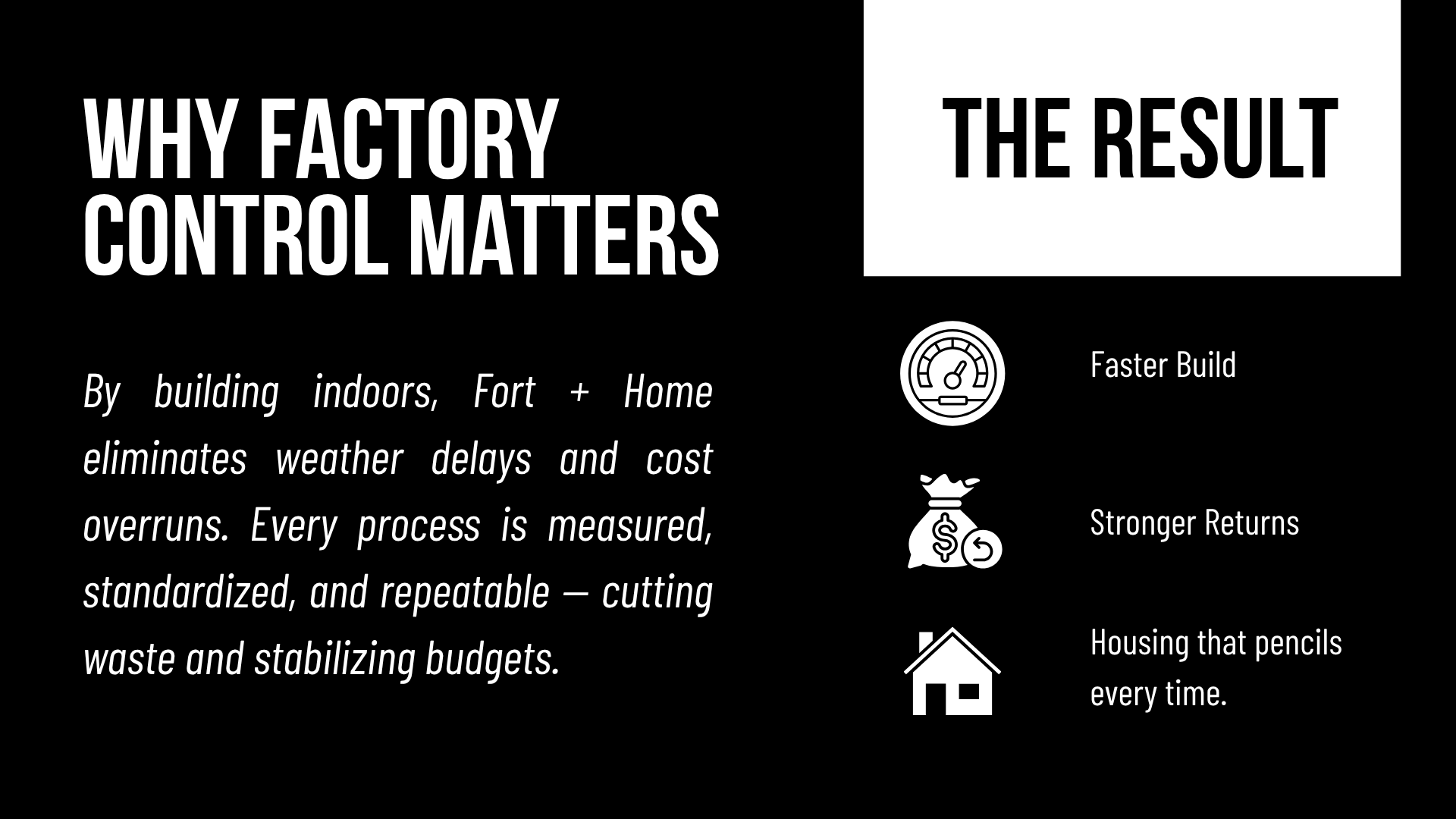

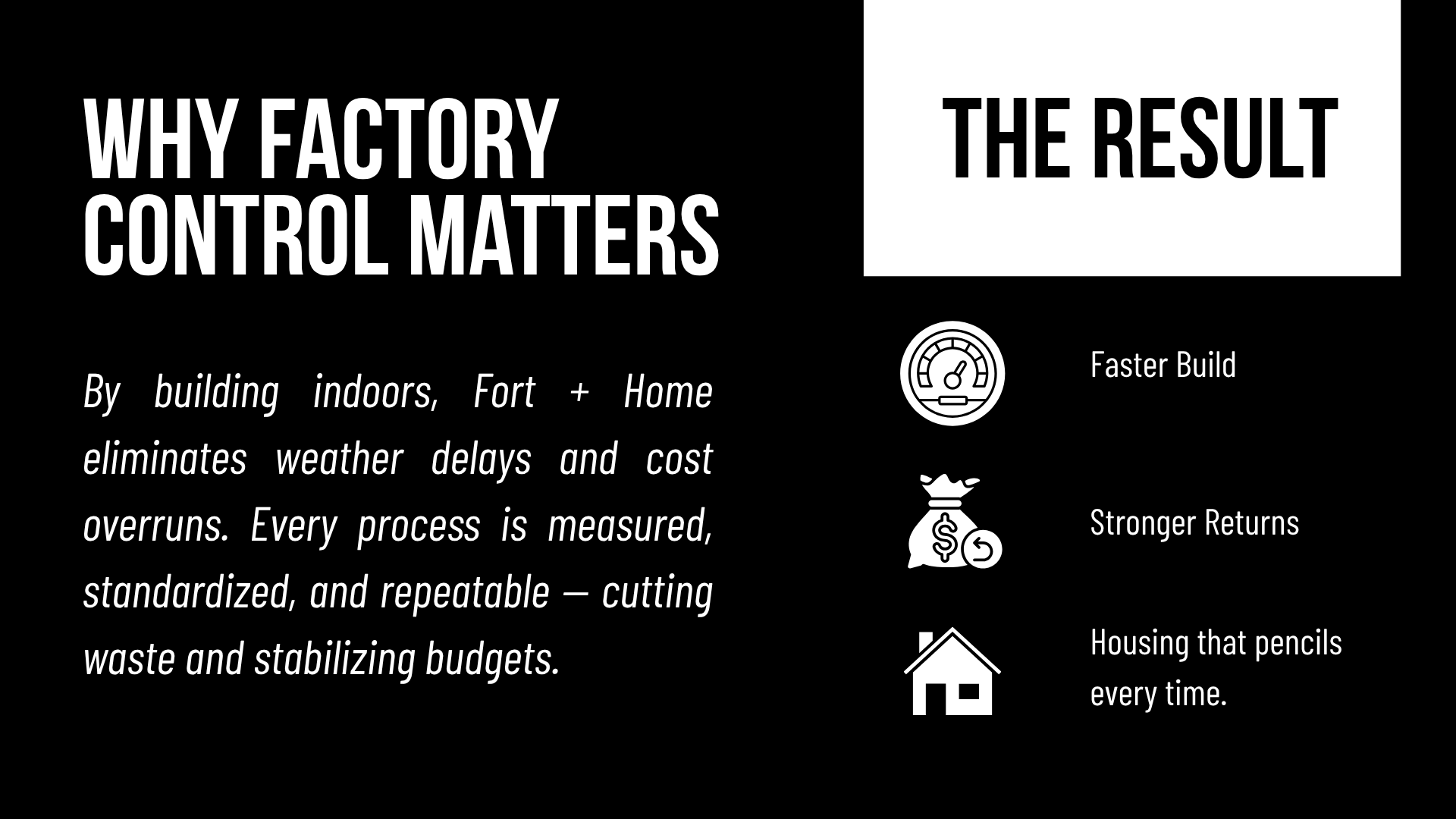

Step 5: Why Factory Control Improves Returns

Factory precision transforms the three levers of real estate performance:

- Speed: Site and factory work run in parallel, compressing project timelines.

- Cost Efficiency: Bulk material purchasing and indoor labor stabilize pricing.

- Quality: Controlled conditions and tighter build envelopes reduce rework and warranty issues.

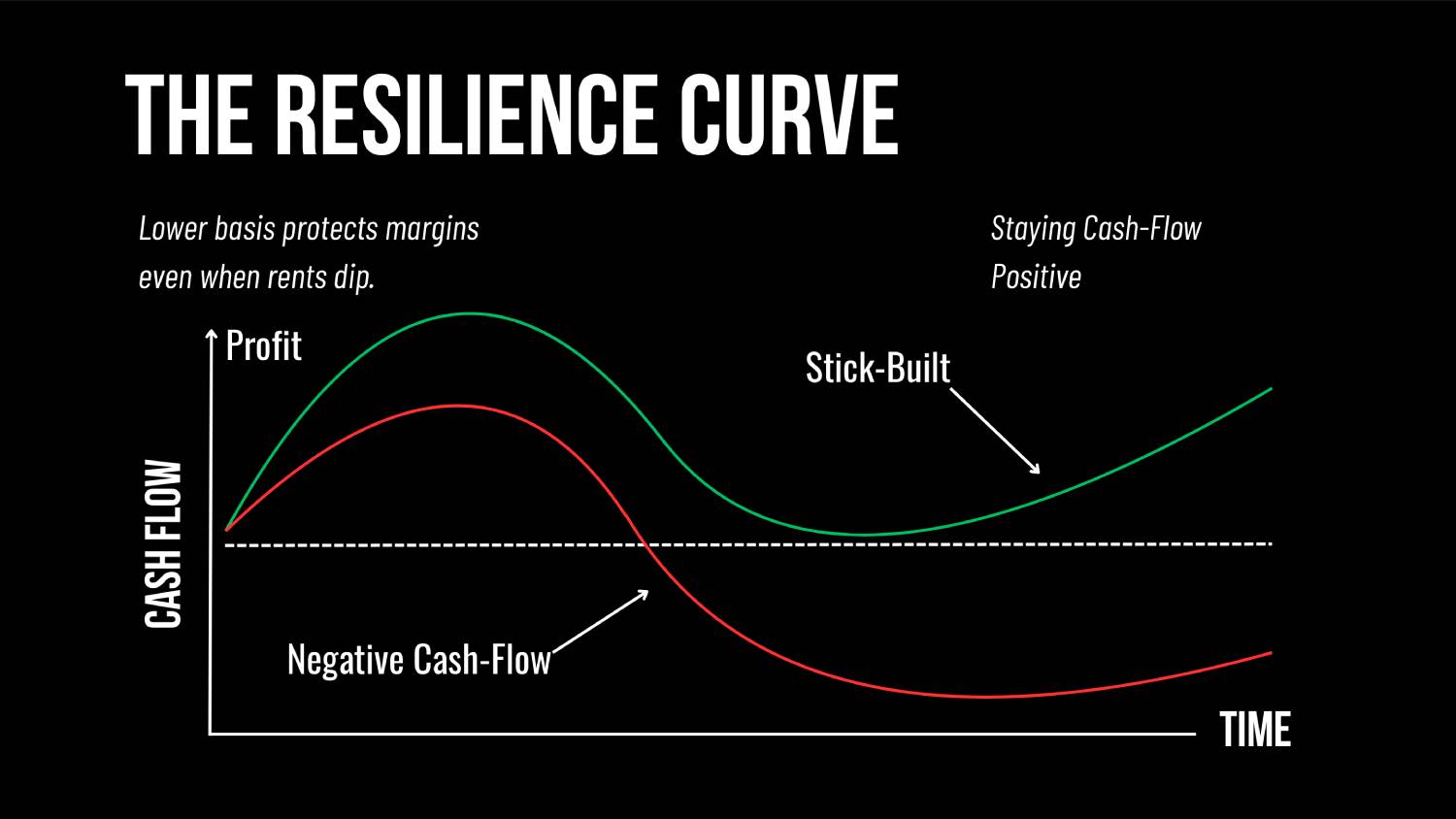

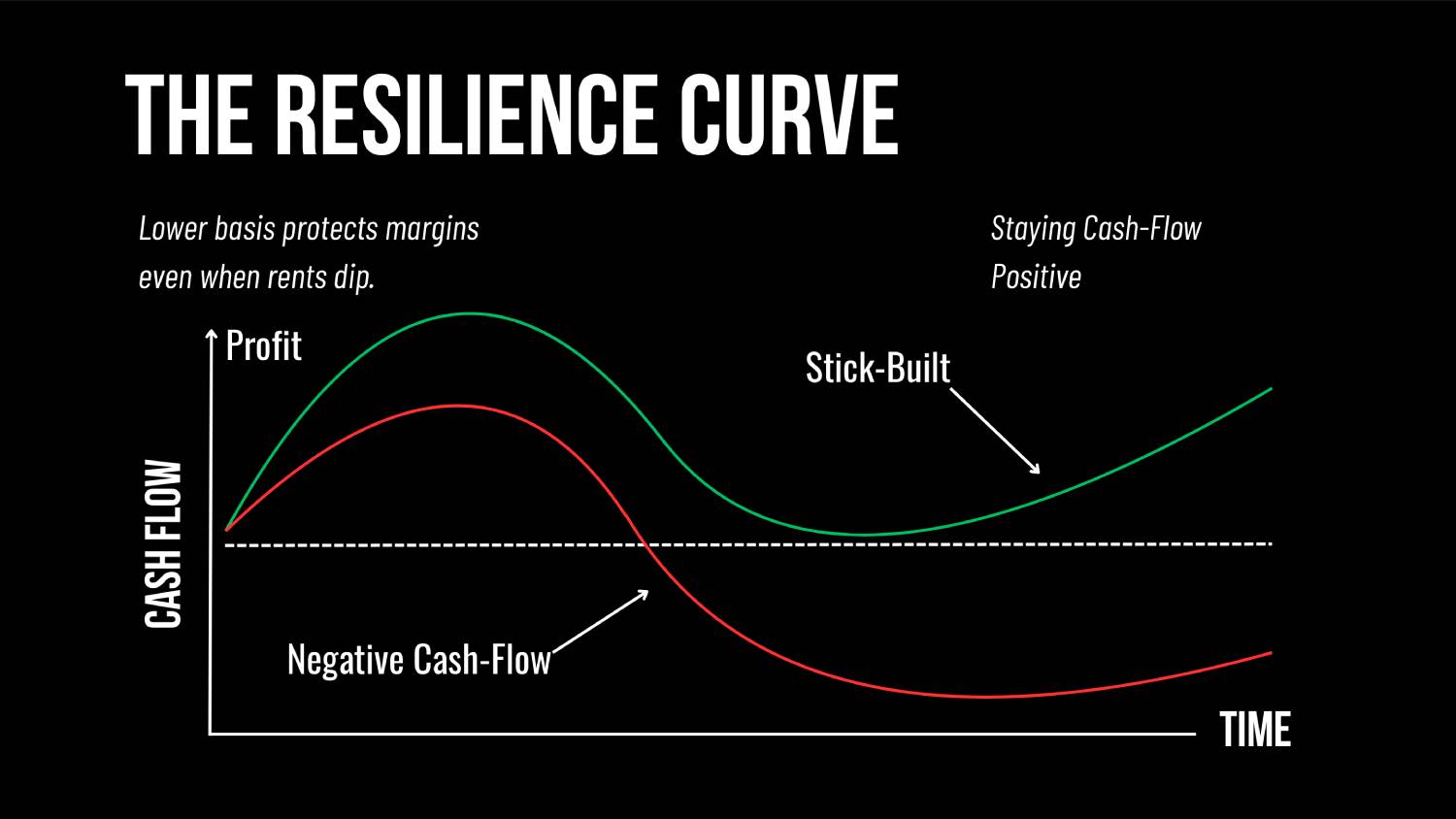

These operational advantages create a compounding financial effect:

- Lower basis = higher cap rate.

- Lower financing and carry = higher cash-on-cash.

When rents dip 5%, lower-basis projects stay cash-flow positive.

When rents rise 5%, they capture more upside per rent dollar.

That resilience keeps deals investable through all market cycles.

Step 6: Built for the Rockies

In the mountains, timing is everything.

Short build windows and weather delays can erode returns overnight.

Fort + Home’s Grand Junction factory builds year-round, installing homes in days, not months.

From our Western Colorado hub, we deliver predictable costs and schedules to markets like Aspen, Vail, Steamboat, Telluride, and Durango.

Predictability equals stronger NOI, which drives better cap rates and stronger cash-on-cash returns.

Step 7: Sustainability Is Practical Finance

Efficiency is profitability.

Our precision-built approach delivers measurable financial and environmental benefits:

- Up to 90% less jobsite waste

- ~35% lower embodied carbon

- 20–30% better energy performance

Lower energy use = lower operating costs = higher NOI.

Sustainability isn’t just environmental — it’s financial durability.

Conclusion: Factory Precision = Better Numbers + Better Housing

Cap rate grades the property.

Cash-on-cash grades your gains.

When you control cost per square foot inside a factory, you improve both — without relying on rent spikes or market speculation.

At Fort + Home, we’re building homes families can afford, investors can trust, and communities can sustain.

If you’re a developer, investor, or top-tier talent, connect with us at fortandhome.com to learn more.

Together, we’re building a system — and a team — designed to house one million families in our lifetime.