Imagine the Rockies Without Their Workforce

Imagine a teacher in Vail, Colorado, or a nurse in Park City, Utah, unable to afford a home in the community they serve. Since 2012, home prices in Colorado’s mountain towns have surged over 200%, turning modest family homes into luxuries out of reach for 70% of local workers. Across the Rocky Mountain region, from Montana to Wyoming, a housing crisis is squeezing out the very people who keep these communities alive.

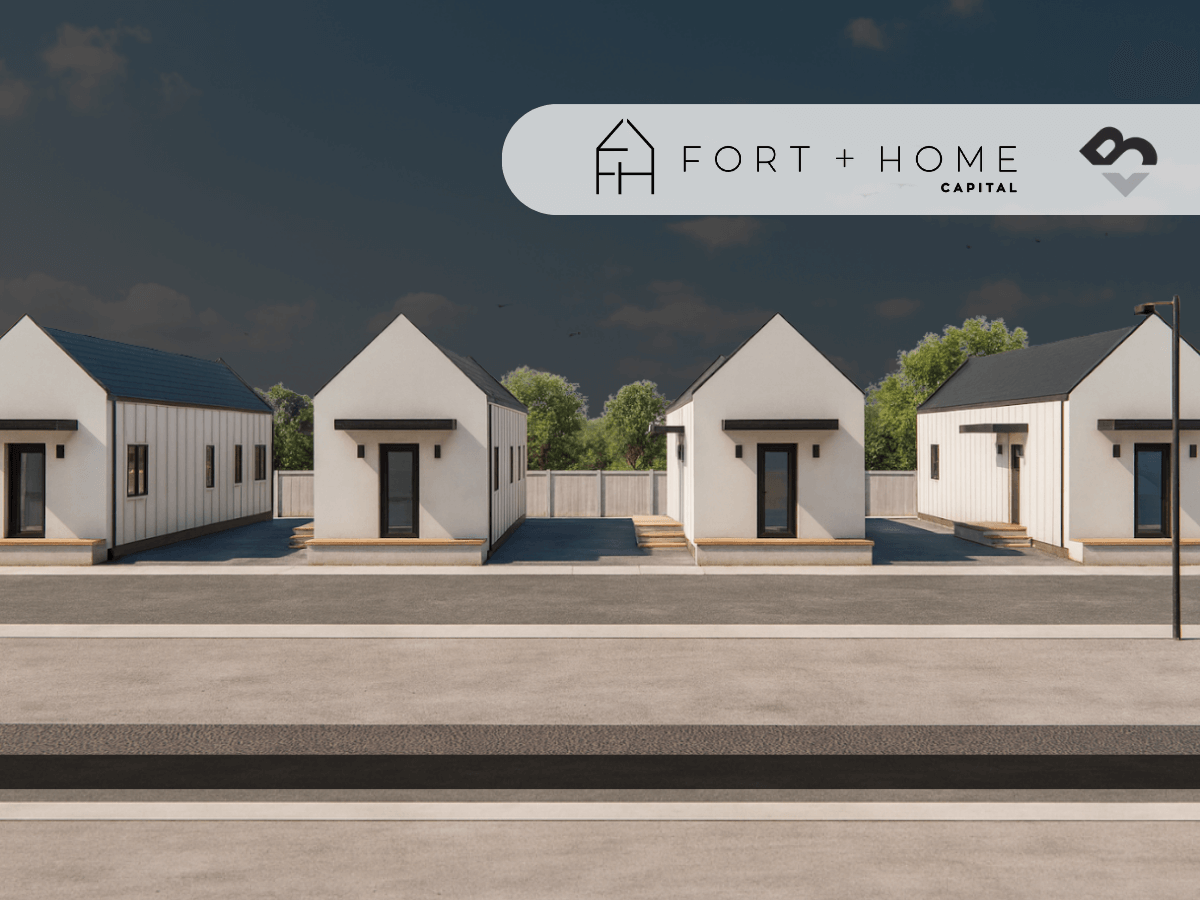

At Fort + Home, we’re tackling this head-on with a vertically integrated model that delivers attainable, high-quality homes. Here’s how we’re doing it — and why it matters now.

The Rocky Mountain Housing Crisis: A Perfect Storm

The housing market in the Rockies is under unprecedented pressure, driven by high interest rates, soaring prices, and chronic supply shortages:

- Interest Rates Stay Stubborn: As of this week, the 30-year fixed mortgage averages 6.29% — nearly double the long-term norm of 4–5%. The Fed’s lone 25 basis point cut in September was its first of the year and barely moved the needle. At today’s rates, a $500,000 home costs families an extra $300 a month — or $3,600 a year — compared to 2021.

- Colorado’s Shortfall: The State Demography Office reports a 106,000-unit deficit as of 2023. Even after a boom that added 43,000 units annually from 2020–2023, Colorado still needs 34,000 new homes every year — 93 per day — just to keep pace. Nearly 70% of residential land bans affordable housing types like townhomes and apartments.

- Utah’s Growing Gap: Utah faces a 37,000-unit shortfall, with only 30 affordable rentals per 100 extremely low-income households. Median prices are at $558,000, already pricing out 87% of renters. At this pace, the statewide median could hit $1 million by 2030.

- Montana’s Struggle: Renters face a 15,000-unit deficit, with nearly half of households cost-burdened, spending over 50% of income on rent. In Bozeman, the median home price is now $745,000.

- Wyoming’s Crisis: Ranking second-worst nationally for affordable housing, Wyoming offers just 50 affordable rentals per 100 low-income households. A $75,000 income can afford only 21% of listings.

- Resort Towns in Peril: In Colorado’s Eagle County, prices have soared 209% since 2012. Summit County, Utah, hit a $1.79 million median last year, while Wasatch lost over 4% of its long-term housing stock to short-term rentals in a single year. The surge in second-home demand is pricing out essential workers, leaving towns hollowed by vacant vacation homes.

The takeaway: Demand is relentless, but traditional development models — slow, costly, and vulnerable to high rates — can’t keep up in these supply-constrained markets.

Fort + Home’s Solution: Vertical Integration

At Fort + Home, we’re redefining how homes are built in the Rockies through vertical integration.

We control the entire value chain:

- Capital → Funding projects with a mix of debt and equity for stability and upside.

- Development → Securing and entitling land to build vibrant communities.

- Manufacturing → Precision-building homes in our Grand Junction, Colorado factory.

- Realty → Selling Build-to-Sell homes to first-time buyers, retirees, and workforce families.

- Asset Management → Operating Build-to-Rent communities with long-term, professional management.

This isn’t just logistics — it’s strategy. By owning the supply chain, we cut costs by up to 20%, reduce reliance on subcontractors, and build resilience against market volatility.

Our factory leverages modular and panelized systems, delivering:

- Cost Savings: Up to 25–30% through off-site efficiencies.

- Faster Timelines: 20–50% shorter build times, avoiding weather delays and site inefficiencies.

- Sustainability: Up to 90% less waste and 35% lower embodied carbon.

- Energy Efficiency: Homes 22% more efficient, saving families 20–30% on utilities from day one.

At Fort + Home, quality is non-negotiable. Our homes aren’t just more affordable — they’re built to last, designed for sustainability, and tailored to the needs of Rocky Mountain communities.

A Win-Win Model for All

Our approach aligns the interests of every stakeholder:

- Investors → Stable debt yields and equity upside, with vertically integrated firms outperforming traditional developers by 15–20% on returns.

- Fort + Home → Scale and resilience, tackling deficits like Colorado’s 106,000-unit gap, Utah’s 37,000-unit shortfall, Montana’s 15,000-unit deficit, and Wyoming’s severe shortage.

- Homebuyers → Access precision-built homes 12–25% more affordable per square foot, plus long-term savings from energy efficiency.

- Residents → Stability and professional management in Build-to-Rent communities, critical in regions where nearly half of renters are cost-burdened and ownership is out of reach.

This model is capital-efficient, scalable, and impactful. One innovative build doesn’t just house a family — it strengthens an entire community.

Why Now?

The Rocky Mountain housing crisis isn’t just a problem — it’s an opportunity. High barriers to entry, strict zoning, and relentless demand create the perfect conditions for Fort + Home’s approach. As traditional models falter under high rates and rising costs, our vertically integrated, precision-built system delivers homes faster, cheaper, and better — while generating strong returns for investors and stability for communities.

Join Us on the Journey

This is just the beginning. Through our Builder’s View series, I’ll share deeper insights into real estate fundamentals — cap rates, cash flow, IRR — and how they tie to our projects. We’ll explore market updates, construction innovations, and how we’re leveraging AI and automation to stay ahead.

At Fort + Home, we’re building a system to house 1 million families in my lifetime. If you’re an investor, industry professional, or simply passionate about solving the housing crisis, let’s connect. Together, we can build the future, one home at a time.